Blog

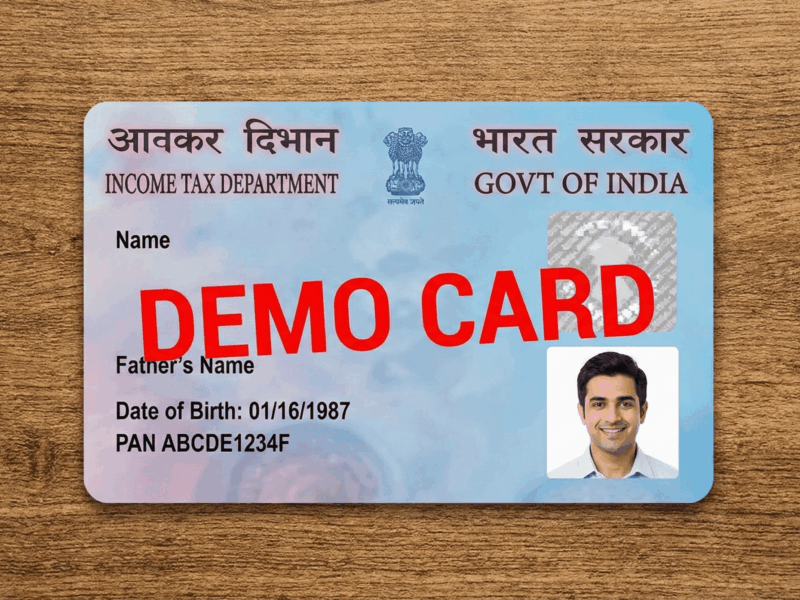

PAN Card Services – New Application, Re-Print & Correction

Welcome to Maheshwari Store's PAN Card Services

What is a PAN Card?

Your PAN number remains the same throughout your life and cannot be changed.

Our Three PAN Card Services

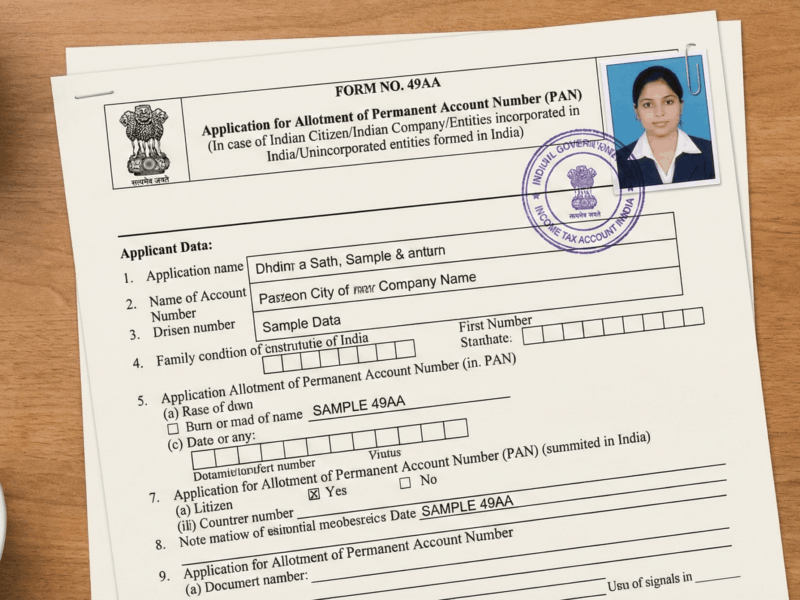

1. Apply for New PAN Card

A new PAN card application is required when you don’t have a PAN number. Any resident of India (Indian citizen or foreign national) can apply for a new PAN card. The PAN number is unique to an individual and remains constant even if you change your name or address.

Who Needs to Apply for PAN Card?

Benefits of Having a PAN Card:

Documents Required for New PAN Application:

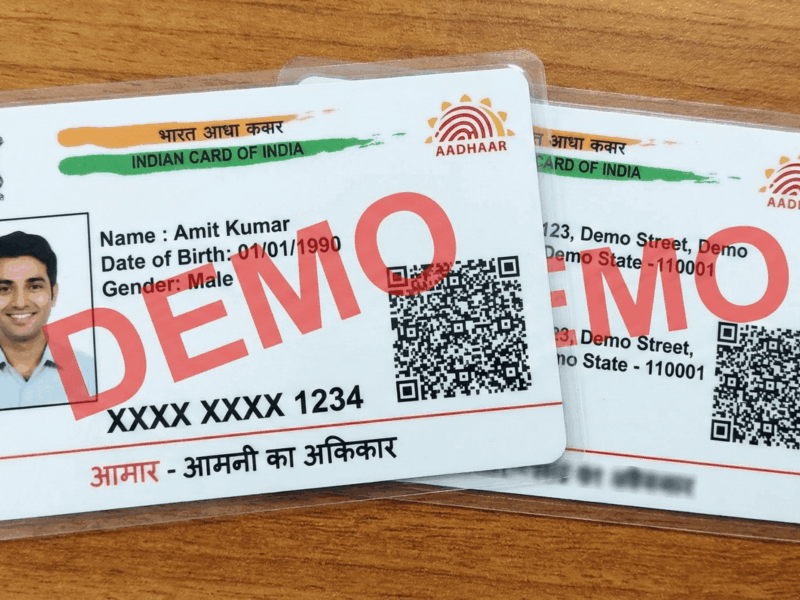

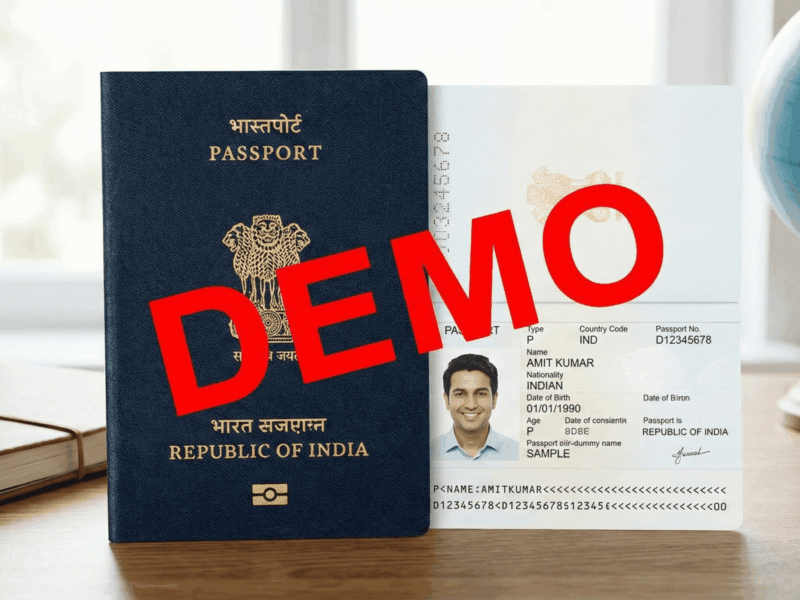

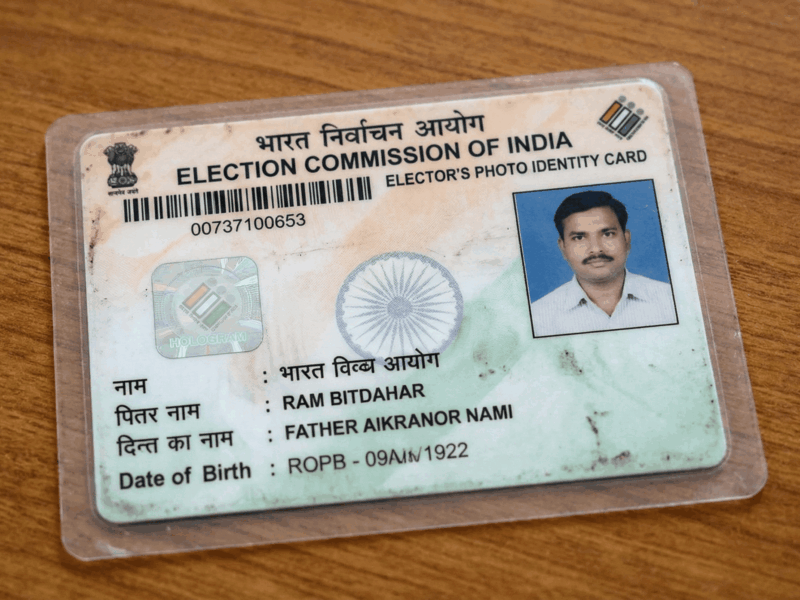

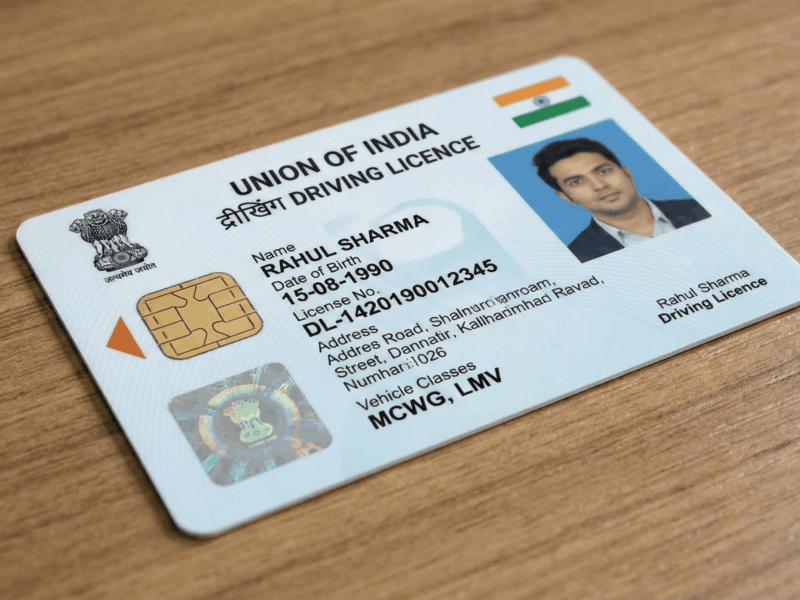

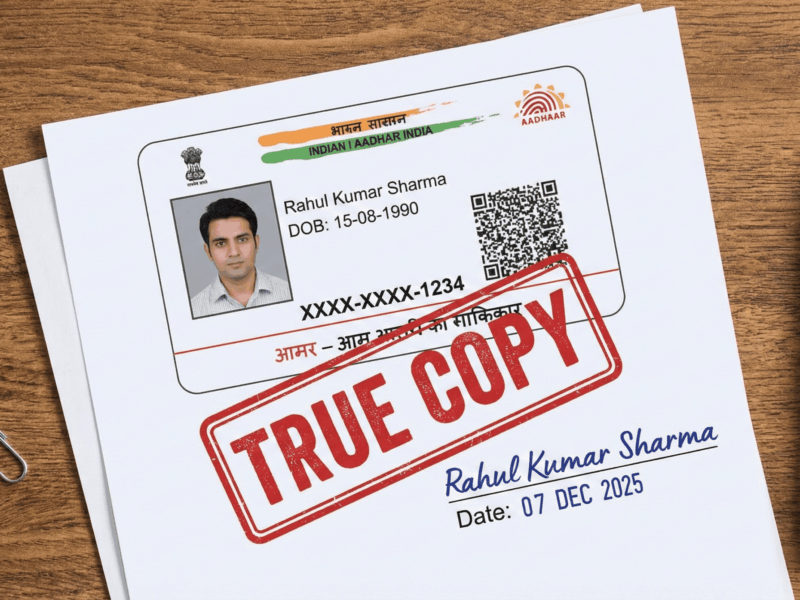

Identity Proof (Any one of the following):

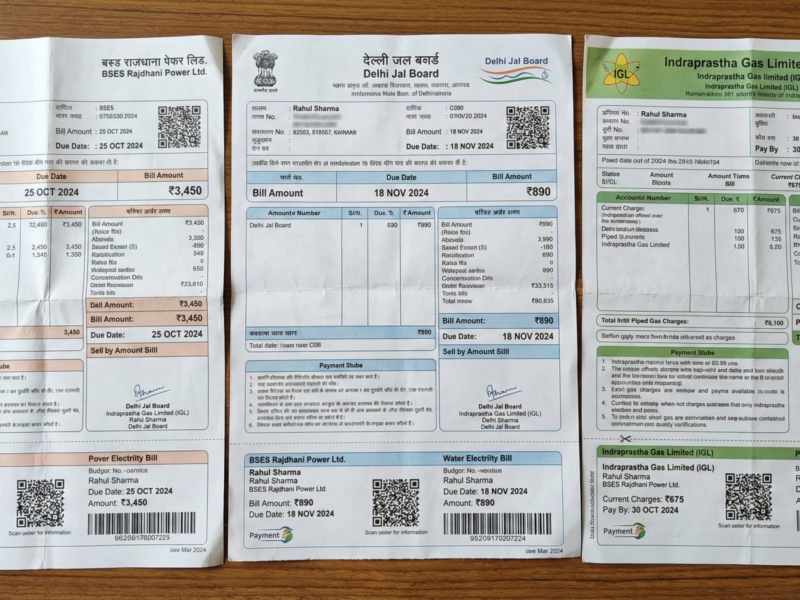

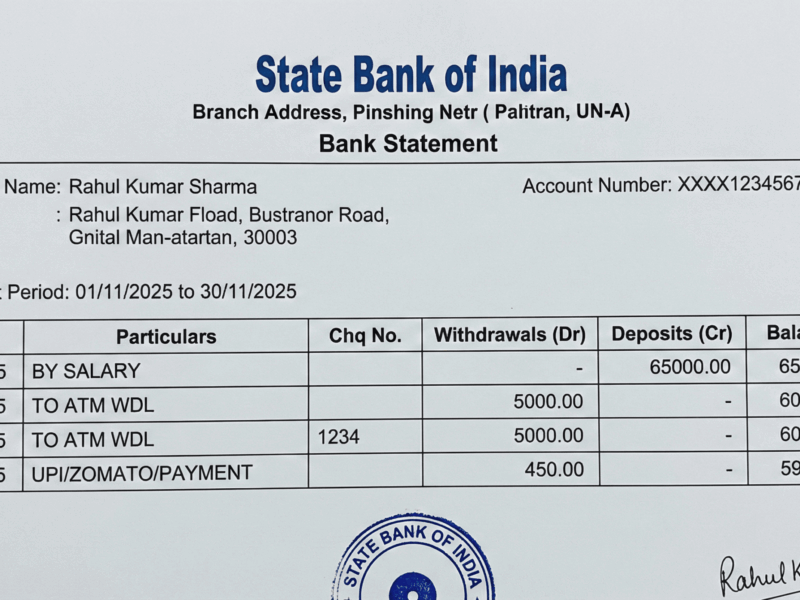

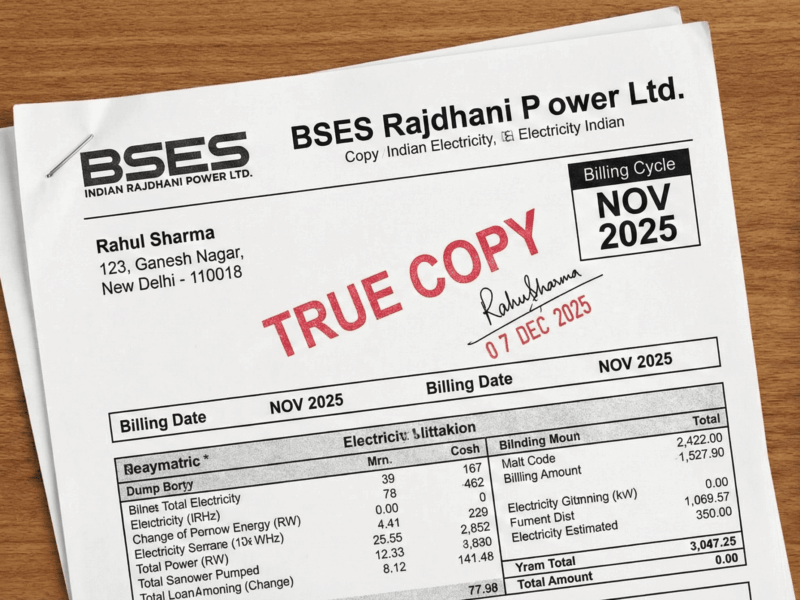

Address Proof (Any one of the following):

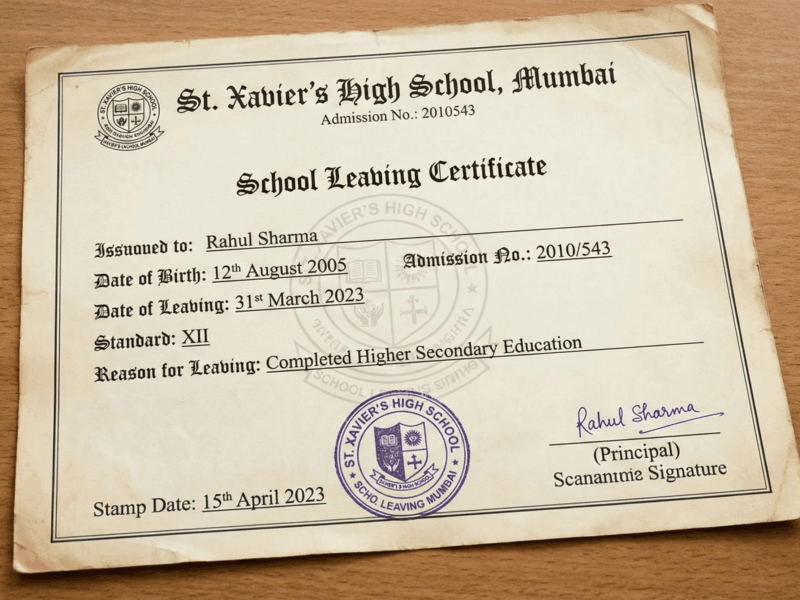

Additional Documents:

How to Apply for New PAN Card:

2. Re-Print PAN Card

PAN re-printing is the process of obtaining a duplicate/new physical copy of your PAN card. Your PAN number (10-digit code) remains the same, but you get a new card with updated information or because your old card is damaged, lost, or worn out.

When Do You Need to Re-Print Your PAN Card?

Why Re-Print Your PAN Card?

Documents Required for PAN Re-print:

How to Re-Print Your PAN Card:

Processing Time: 5-7 working days

Cost: Economical service charges (less than new application)

Validity: Same as original – lifetime

Note: PAN number does NOT change during re-print

3. Correction in PAN Card

When Do You Need to Correct Your PAN Card?

Why Correct Your PAN Card?

Types of Corrections:

Category A Correction (Minor Changes):

- Name spelling correction

- Address change

- Phone/email update

- Simple, non-identity related changes

- Quick processing: 3-5 days

- May not require supporting documents

Category B Correction (Major Changes):

- Date of birth change

- Category change

- Identity-related corrections

- Requires supporting documents

- Processing: 5-7 days

- Requires verification

Documents Required for PAN Correction:

Always Required:

- Original PAN card

- Completed correction form (Form 49A – we provide)

- Color photograph (4×6 cm)

- Identity proof (Aadhaar, Passport, Voter ID, etc.)

For Name Correction:

- Identity proof with corrected name

- Affidavit if name change through marriage/legally

- Marriage certificate (if applicable)

For Date of Birth Correction:

- Birth certificate or

- School certificate with date of birth or

- Passport

- Educational certificate

For Address Correction:

- Current address proof (utility bill, bank statement, etc.)

- Address must not be older than 3 months

For Category Change:

- Identity proof

- Supporting document for category change

- Updated Form 49A with category details

How to Correct Your PAN Card:

Step 1: Visit Our Service Center

- Bring original PAN card

- Bring all required documents

- Bring color photograph

- Bring corrected details in writing

Step 2: Document Verification

- Our staff reviews your documents

- Verifies the information to be corrected

- Checks authenticity of supporting documents

- Identifies category of correction (A or B)

Step 3: Identify Correction Type

- Category A: Minor corrections (quick processing)

- Category B: Major corrections (requires verification)

- Determine what documents are needed

- Check if affidavit is required

Step 4: Form Completion

- Fill Form 49A (Correction form – we provide)

- Specify current PAN number

- Mention the details to be corrected

- Provide correct information

- List supporting documents attached

Step 5: Document Attachment

- Attach copies of supporting documents

- Copies certified/attested as required

- Photo clearly attached

- Signature on all required places

Step 6: Submission

- Submit complete application to Income Tax Department

- Reference number provided

- Acknowledgment receipt given

- Tracking number noted

Step 7: Verification & Processing

- Income Tax Department verifies information

- May contact you if additional documents needed

- Processing takes 3-7 days depending on correction type

- Updated PAN card issued

Step 8: Receive Corrected PAN Card

- New PAN card sent to your address

- Same PAN number but with corrected information

- Digital copy available online

- Ready to use immediately

Why Choose Maheshwari Store?

Professional & Authorized Service

✓ Authorized PAN Service Provider

✓ Trained and certified staff

✓ Income Tax Department recognized center

✓ Complete documentation support

✓ Secure handling of personal information

Fast & Efficient Processing

✓ Quick verification process

✓ Minimal waiting time

✓ Same-day form submission

✓ Regular status updates

✓ Guaranteed processing within stipulated time

✓ Fastest turnaround in market

Expert Guidance

✓ Knowledge about all three PAN services

✓ Help identify which service you need

✓ Guide on document requirements

✓ Assistance with form filling

✓ Support throughout the process

Customer-Friendly Service

✓ Hindi and English language support

✓ Friendly and professional staff

✓ Transparent fee structure

✓ No hidden charges

✓ Walk-in or appointment-based services

✓ Convenient operating hours

Reliable & Trustworthy

✓ Years of experience in tax services

✓ Hundreds of satisfied customers

✓ Secure data handling

✓ Complete confidentiality

✓ After-service support available

✓ Updates on application status

Competitive Pricing

✓ Best rates in the market

✓ Clear fee breakdown for each service

✓ No additional hidden charges

✓ Transparent payment options

✓ Value for money service

Frequently Asked Questions (FAQs)

New PAN Card Application FAQs

A: Usually 7-10 working days from the date of application. You receive your physical PAN card by mail at your registered address.

A: The Income Tax Department charges a minimal fee. We provide additional service charges for assistance. Contact us for current rates.

A: While not mandatory, Aadhaar makes the process smoother. You can apply with other valid IDs like Passport, Voter ID, or Driving License.

A: Yes, you can apply online directly, but our center provides complete guidance and ensures accurate submission, reducing rejection risks.

A: PAN is a 10-digit alphanumeric number in format: AAAA*A1234A. First 5 characters are letters, next 4 are numerals, last 1 is a letter.

A: No, once issued, your PAN number is permanent and never changes, even if your name or address changes.

A: No, one PAN is sufficient. However, businesses (like partnerships) may have a different PAN from individuals.

A: Only one PAN per person is allowed. Having multiple PANs is illegal.

A: Not mandatory for everyone, but required if you file ITR, earn above ₹2.5 lakhs (for most), or make transactions above ₹50,000 with banks.

A: Yes, using Form 49AAA with additional documents like foreign address proof and passport.

PAN Re-print FAQs

A: Your PAN number remains the same. Only the physical card is replaced with an updated version.

A: Generally 5-7 working days from submission date.

A: Yes, you can re-print with your new name. Provide marriage certificate as supporting document.

A: Affidavit is usually not required for simple re-printing. It may be needed if your address or other details have changed significantly.

A: Yes, we can arrange for you to collect your re-printed PAN card from our center once it’s ready.

A: Contact us immediately. We’ll check the status with the Income Tax Department and expedite if possible.

A: Income Tax Department charges a minimal fee. We provide service charges for our assistance.

A: You can apply online, but visiting our center ensures no errors and faster processing.

A: You can re-print again. There’s no limit on re-printing.

A: The PAN number remains valid. Your old physical card may be considered outdated, but the number is still yours.

PAN Card Correction FAQs

A: Category A (minor) corrections take 3-5 days. Category B (major) corrections take 5-7 days.

A: Most corrections require supporting documents. Name and address changes definitely need proper documentation.

A: Yes, you can apply online, but our center provides expert guidance and handles documentation properly.

A: We’ll inform you of the rejection reason and resubmit with correct documents.

A: Yes, category can be changed with proper documentation and declaration forms.

A: Yes, address correction ensures your ITR and other communications reach the correct location.

A: Yes, you can correct multiple items if they’re all related. Sometimes it’s better to submit separately.

A: Your PAN number remains the same. Only the information stored against it is updated.

A: Income Tax Department charges nominal fee. We add service charges for our assistance.

A: You can check on the Income Tax website or we’ll provide you with tracking details.

Service Comparison Table

| Feature | New PAN | Re-Print | Correction |

|---|---|---|---|

| Processing Time | 10-15 Days | 7-10 Days | 20-25 Days |

| Cost | Standard | Standard | Standard |

| PAN Number | New | Same | Same |

| Documents Requirement | More | Moderate | Varies |

| Complexity | Moderate | Low | Moderate - High |

| Best For | First-time applicants | Lost/Damaged cards | Fixing errors |

Common Issues & Solutions

Issue: Form Rejection Due to Incorrect Details

- Ensure all names match across documents

- Double-check spelling of name

- Verify address matches documents

- Check date of birth accuracy

- Resubmit with corrected information

Issue: PAN Card Delayed (Beyond 10 Days)

- Check application status online with reference number

- Verify documents were properly submitted

- Contact Income Tax Department helpline

- Contact us for follow-up assistance

Issue: Received Wrong PAN Card

- Notify us immediately

- Don’t use the incorrect PAN

- File complaint with Income Tax Department

- Request reissuance with correct details

Issue: Not Received Physical PAN Card

- Wait for full 10 days before follow-up

- Check if address change caused delivery issue

- Request digital PAN certificate from us

- Contact postal service if address is correct

Re-print Issues

Issue: Address on Re-printed Card Still Shows Old Address

- Old address was in system when card was printed

- Submit separate address correction request

- Provide updated address proof

- New card will reflect updated address

Issue: Photo Quality Poor on Re-printed Card

- Re-print with better quality photograph

- Use high-resolution color photo (4×6 cm)

- Submit again with clear image

- No additional cost for quality re-print

Issue: Re-printed Card Shows Old Name

- Name correction wasn’t processed

- Submit name correction request

- Provide marriage certificate if applicable

- Reprint will show updated name

Correction Issues

Issue: Correction Request Rejected

- Review rejection reason from Income Tax Department

- Gather supporting documents as specified

- Resubmit with additional proof

- Contact us if documents need certification

Issue: Correction Takes Longer Than Expected

- Category B corrections naturally take longer

- Income Tax Department may request additional documents

- Be prepared to submit more proof if needed

- Check status using reference number regularly

Issue: Name Still Shows Incorrectly After Correction

- It may take 2-3 working days to reflect in all systems

- Check again after waiting period

- If still wrong, file another correction request

- Provide additional document proving correct name

Document Checklist for All Services

New PAN Application Checklist

- Original Identity Proof (Aadhaar/Passport/Voter ID/DL)

- Original Address Proof

- Birth Certificate/School Certificate (copy)

- Photographs (3 pieces, 4×6 cm, color)

- Copy of address proof

- Copy of identity proof

- Completed Form 49AA/49AAA

- Signature specimen

PAN Re-print Checklist

- Original PAN Card

- Original Identity Proof

- Photographs (2 pieces) if address changed

- Address proof if changing address

- Original supporting document

- Completed re-print form

- Copy of PAN card

PAN Correction Checklist

- Original PAN Card

- Original Identity Proof

- Completed Form 49A

- Supporting documents for correction

- Photograph (fresh, 4×6 cm)

- Address proof (if correcting address)

- Marriage certificate (if name changed)

- Copy of corrected documents

Important Points to Remember

Security & Privacy

🔒 Your PAN information is confidential with us

🔒 We follow Income Tax Department data protection guidelines

🔒 Never share your PAN with unauthorized parties

🔒 All documents handled securely and confidentially

🔒 Digital submission through secure channels only

PAN Card Guidelines

✓ PAN is a 10-character alphanumeric identifier

✓ Issued once and valid for lifetime

✓ Never changes even if name/address changes

✓ Cannot be transferred or inherited

✓ Only one PAN per person (having two is illegal)

✓ Mandatory for certain tax and financial transactions

Filing Requirements

✓ File ITR if income exceeds taxable limits

✓ Self-employed must file even if income below limits

✓ Business owners must file annually

✓ Financial transactions above ₹50,000 require PAN

✓ Honest disclosure of income is mandatory

✓ Updated contact information helps Income Tax reach you

Things to Avoid

✗ Don’t share PAN with unnecessary parties

✗ Don’t apply for multiple PAN numbers

✗ Don’t submit fake or forged documents

✗ Don’t ignore Income Tax Department notices

✗ Don’t provide incorrect information intentionally

✗ Don’t delay corrections if information is wrong

✗ Don’t miss ITR filing deadlines

Service Timeline

| Activity | Timeline |

|---|---|

| New PAN | |

| Document Verification | Same day |

| Form Submission | Same day |

| ITD Processing | 7-10 working days |

| Physical Delivery | Via postal mail |

| Re-Print | |

| Verification | Same day |

| Form Submission | Same day |

| ITD Processing | 5-7 working days |

| Delivery | Postal or collection |

| Correction | |

| Document Review | Same day |

| Category Identification | Same day |

| Submission | Same day |

| Processing | 3-7 working days |

| Update Notification | Via email/SMS |

Contact Information

Maheshwari Store

📍 Address: H No. 166, St. No. 5, Mandoli Extn., North East, Delhi - 110093

📞 Phone: +91-9818958975

📧 Email: support@maheshwaristore.com

🌐 Website: www.maheshwaristore.com

Service Channels:

- Direct Walk-in Service Available

- Appointment Booking Available

- WhatsApp Service Query Available

- Email Support Available

- Phone Consultation Available

How to Book Your Appointment

Online Booking:

- Visit www.maheshwaristore.com

- Select "Book Appointment"

- Choose service (New/Re-print/Correction)

- Select preferred date and time

- Receive confirmation SMS

Direct Booking:

- Call us at +91-9818958975

- WhatsApp on +91-9818958975

- Visit center in person

- Email your details to support@maheshwaristore.com

Appointment Benefits:

- No waiting time

- Dedicated staff support

- Priority processing

- Convenient scheduling

- Guaranteed quick service

- Expert guidance throughout

Why Choose Maheshwari Store for PAN Services?

⭐ Expertise & Experience

- Years of experience in income tax services

- Expert staff trained in PAN procedures

- Latest knowledge of Income Tax updates

- Understanding of all three PAN services

- Proficiency in handling complex cases

⭐ Speed & Efficiency

- Fastest processing in the market

- Same-day form submission

- Regular status tracking

- Minimal rejection rates

- Quick turnaround guaranteed

⭐ Transparency & Trust

- Clear pricing without hidden charges

- Honest assessment of requirements

- Complete information sharing

- Documented process

- Professional approach

⭐ Customer Service

- Friendly and professional team

- Hindi and English support

- Patient explanation of procedures

- Problem resolution focus

- Post-service follow-up

⭐ Quality & Reliability

- Authorized service provider

- Income Tax Department recognized

- 100% accurate submissions

- Secure document handling

- Guaranteed successful processing

Related Services We Provide

FAQs - Additional Questions

A: Both are the same. e-PAN is the digital certificate, physical PAN is the card form. Both are equally valid.

A: Yes, you can use your PAN number for transactions as soon as it’s issued, even before receiving the physical card.

A: No, PAN doesn’t get deactivated. However, if you file ITR, it must be done by the deadline.

A: Yes, address can be updated separately. Physical card update depends on your preference.

A: As many times as needed. Each update takes 3-7 days to process.

A: Yes, PAN remains valid. Update your address to your foreign address with supporting documents.

A: No, PAN is valid for lifetime. No renewal required.

A: Yes, all businesses (sole proprietor, partnership, company, HUF) must have PAN.

A: Can face penalties up to ₹10,000 plus interest on taxes, depending on situation.

A: Visit www.incometax.gov.in and download from “e-Services” section. We can help you with this.

Professional Tax Tips

💡 Tip 2: Keep your PAN and address updated to avoid issues during financial transactions

💡 Tip 3: Correct any errors in PAN information immediately - don't postpone

💡 Tip 4: Link your PAN with Aadhaar as mandated by Income Tax Department

💡 Tip 5: File ITR on time to maintain good tax compliance record

💡 Tip 6: Keep copies of all PAN-related documents for future reference

💡 Tip 7: Update address whenever you relocate - helps with government communications

💡 Tip 8: Inform bank of PAN changes if any detail is corrected

Testimonials & Trust

Legal Disclaimer

✓ All information provided is based on current Income Tax Department guidelines

✓ Processing timelines are approximate and may vary

✓ Fees are subject to change and are in addition to Income Tax Department charges

✓ Maheshwari Store is an authorized service provider, not an official government agency

✓ For official information, visit www.incometax.gov.in

✓ This website is not affiliated with the Government of India

Official Income Tax Resources:

- Website: www.incometax.gov.in

- Helpline: 1800-180-1961 (toll-free)

- Email: support@incometax.gov.in